By Ken Holmes | Assistant Vice-President | Centennial

Understanding your credit report is crucial for managing your financial health and making informed decisions about credit and loans. However, credit reports can be filled with complex terminology that may seem confusing at first.

Here we will break down some essential credit report terms that you need to know. By familiarizing yourself with these terms, you’ll be better equipped to navigate your credit report and take control of your financial future.

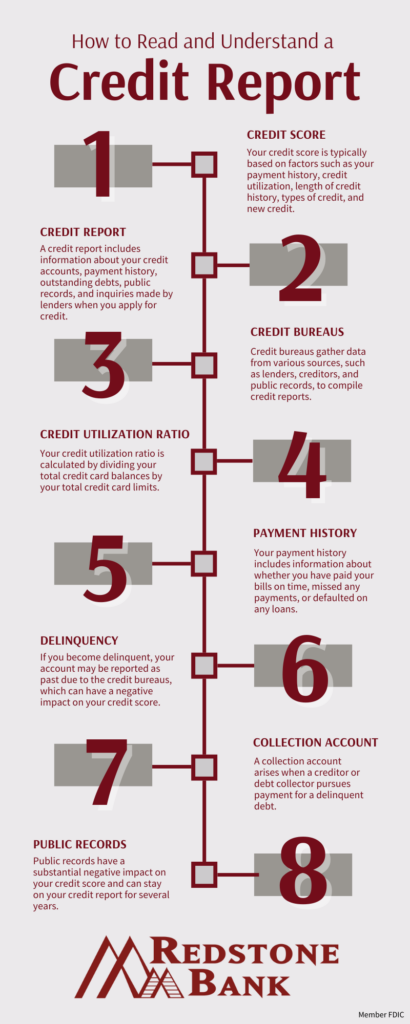

Credit Score:

Your credit score is a three-digit number that represents your creditworthiness. It is typically based on factors such as your payment history, credit utilization, length of credit history, types of credit, and new credit. A higher credit score indicates a lower credit risk and vice versa. Lenders often use credit scores to assess your eligibility for loans, credit cards, and favorable interest rates.

Credit Report:

A credit report is a detailed record of your credit history. It includes information about your credit accounts, payment history, outstanding debts, public records (such as bankruptcies or tax liens), and inquiries made by lenders when you apply for credit. You are entitled to a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once a year.

Credit Bureaus:

Credit bureaus, also known as credit reporting agencies, are companies that collect and maintain credit information about individuals. They gather data from various sources, such as lenders, creditors, and public records, to compile credit reports. The three major credit bureaus mentioned earlier are responsible for generating credit reports for consumers.

Credit Utilization Ratio:

Your credit utilization ratio is the percentage of your available credit that you are currently using. It is calculated by dividing your total credit card balances by your total credit card limits. For example, if you have a total credit limit of $10,000 and your outstanding balance is $2,000, your credit utilization ratio is 20%. Maintaining a low credit utilization ratio (typically below 30%) is generally considered favorable for your credit score.

Payment History:

Your payment history is a record of how you have managed your credit obligations. It includes information about whether you have paid your bills on time, missed any payments, or defaulted on any loans. Payment history is a significant factor in determining your credit score. Consistently making payments by their due dates helps establish a positive payment history. With the Redstone Bank online banking and mobile app, you can easily set up automatic BillPay to ensure you don’t miss payments and stay on track.

Delinquency:

Delinquency refers to the failure to make timely payments on your credit obligations. If you become delinquent, your account may be reported as past due to the credit bureaus, which can have a negative impact on your credit score. Delinquency is typically categorized as 30, 60, 90, or 120 days late, with each category having increasingly severe consequences.

Collection Account:

A collection account arises when a creditor or debt collector pursues payment for a delinquent debt. If you fail to pay your debts, the creditor may sell the debt to a collection agency, who then attempts to collect the outstanding amount from you. Collection accounts can significantly harm your credit score and should be addressed promptly.

Public Records:

Public records on your credit report can include information about bankruptcies, tax liens, civil judgments, and other legal actions related to your financial history. Public records have a substantial negative impact on your credit score and can stay on your credit report for several years.

Familiarizing yourself with these essential credit report terms empowers you to understand your financial standing better. By regularly reviewing your credit report and monitoring these key factors, you can identify areas for improvement and take appropriate steps to maintain or enhance your creditworthiness. Remember, a good credit history opens doors to better financial opportunities and favorable lending terms.