Savings & CDs

Choose an account that fits your lifestyle, not the other way around.

Savings accounts offer liquidity, easy access, and a safe place to accumulate funds. CDs provide higher interest rates with fixed terms, promoting disciplined saving and guaranteed returns, ideal for specific financial goals.

Elevate your financial strategy with Redstone Bank savings accounts

Our savings accounts offer secure deposits, competitive interest rates, and easy online management, empowering you to save for goals confidently. Whether you’re saving for a rainy day or a dream vacation, start maximizing your funds with convenience and peace of mind today.

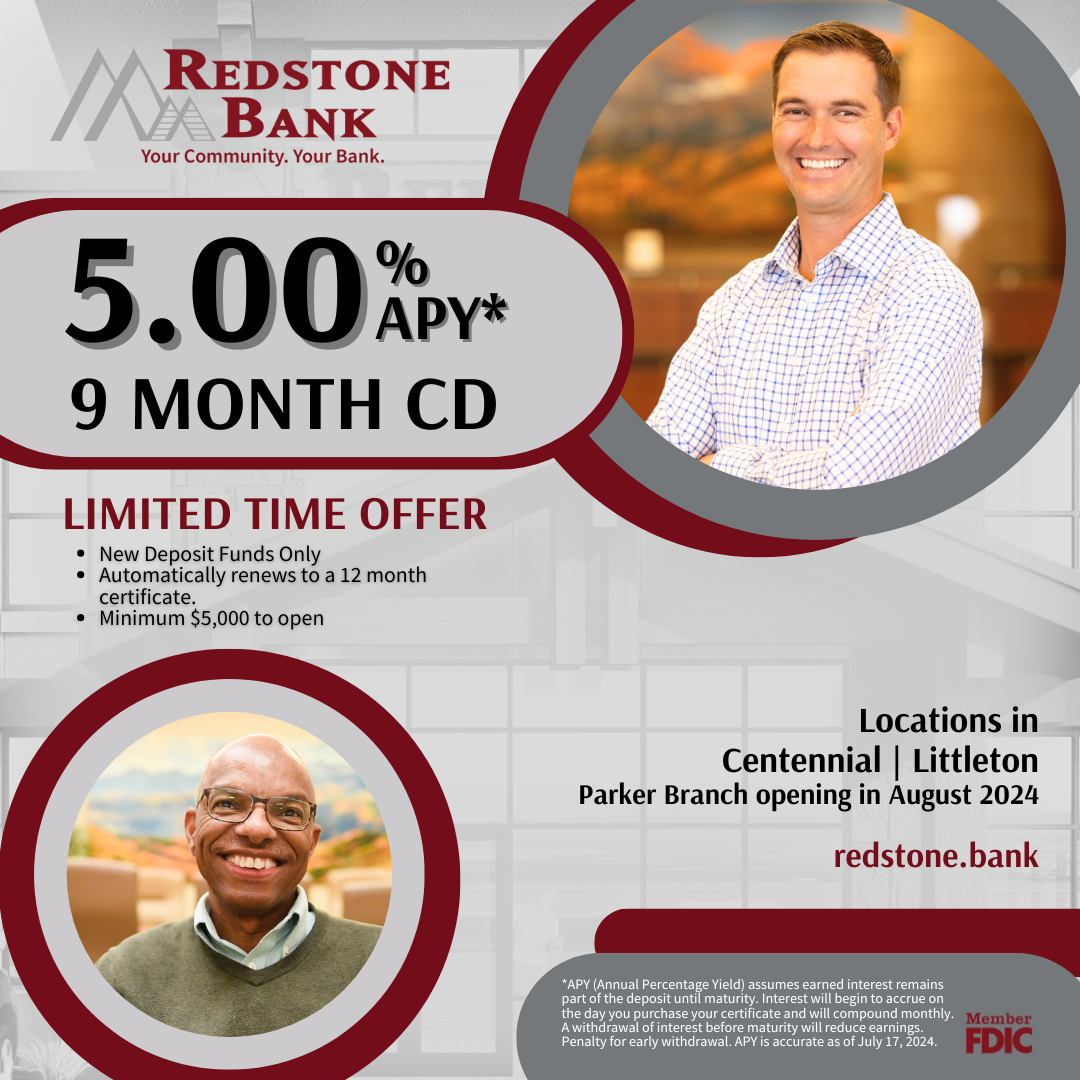

Limited Time Offer! 5.00% APY* 9 Month CD Special

Take advantage of our new 9 Month CD Special at 5.00% APY* for a limited time. Automatically renews to a 12 month certificate. Minimum $5,000 to open. New Deposit Funds Only.

Contact Your Local Branch*APY (Annual Percentage Yield) assumes earned interest remains part of the deposit until maturity. Interest will begin to accrue on the day you purchase your certificate and will compound monthly. A withdrawal of interest before maturity will reduce earnings. Penalty for early withdrawal. APY is accurate as of July 17, 2024.

Savings Account Types & Benefits

CD Types & Benefits

Long-term savings investment. Lock-in interest and watch your money grow. CDs mature after a set period of time. We offer competitive rates and terms, plus an automatic renewal option for your convenience. CDs offer a stable source of savings over a lifetime.

Savings Calculator

Our calculator helps you figure out how much your current savings will grow and how much more you’ll need to save in order to achieve your set goal.

Frequently Asked Questions

Who is eligible for an HSA?

If you are covered under a qualifying high deductible health insurance plan that is compatible with an HSA, and meet the other requirements set by the IRS, you are eligible.

Why would I want to open a CD?

Our Certificates of Deposit are a great way to save money and reach your financial goals with our competitive CD rates.

How am I notified when my CD is mature?

A maturity notice will be mailed or emailed to you a couple weeks prior to the maturity of your CD.

How long is my grace period?

Your grace period extends for a total of 10 calendar days.

What is the penalty for early withdrawal from a CD?

Penalties vary according to the term of the CD. Contact your local Redstone Bank branch to discuss our current CD offers.

We’re here to help

Call your local Redstone Bank branch or contact us online.

Related Resources

All resources

Personal Checking

Manage your money your way. Our checking accounts provide the flexibility to meet your lifestyle and financial needs, letting you manage your money more effectively.

Learn more

Personal & Auto Loans

With nearly 100 years of combined experience, our Redstone Bank loan professionals are ready to help you reach your goals. Whether you’re buying a new car, consolidating your debt, or paying for your child’s education, we are here to help you.

Learn more