By Dillon Joslyn | Business Development Officer | Parker

In today’s world, credit plays a vital role in our financial lives. Whether you’re applying for a loan, renting an apartment, or even setting up utilities, your credit score becomes a key determinant of your financial reputation.

Understanding what constitutes a good credit score and how to achieve one is crucial for anyone aiming to navigate the financial landscape successfully. Let’s look into the world of credit scores, exploring what they are, why they matter, and providing essential tips on how to obtain a good credit score.

What is a Credit Score?

A credit score is a numerical representation of an individual’s creditworthiness, designed to assess the risk of lending money to them. Credit reporting agencies generate it based on the data in your credit report, which includes information about your credit history, payment patterns, debt utilization, and other relevant financial activities. The most widely used credit scoring models are FICO® Scores and VantageScores.

Understanding Credit Score Ranges:

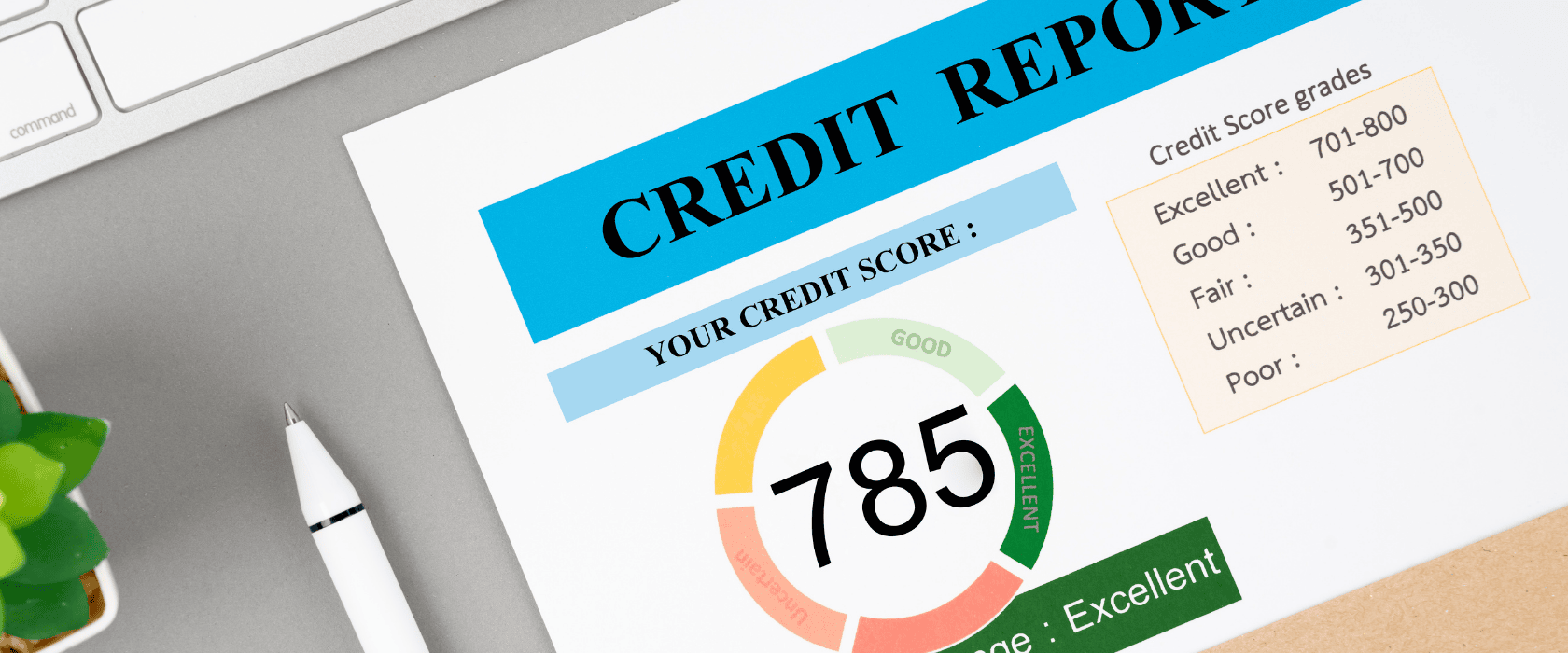

Credit scores typically range from 300 to 850, with higher scores indicating a lower credit risk and vice versa. While the specific ranges may vary among different scoring models, a general breakdown is as follows:

- Poor: 300-579

- Fair: 580-669

- Good: 670-739

- Very Good: 740-799

- Excellent: 800-850

The Importance of a Good Credit Score:

Having a good credit score provides numerous advantages, including:

- Loan Approval: Lenders rely on credit scores to determine whether to approve loan applications and what interest rates to offer. A good credit score increases your chances of obtaining loans at favorable terms.

- Lower Interest Rates: A higher credit score often translates to lower interest rates on loans and credit cards. This can save you thousands of dollars in interest payments over time.

- Rental Applications: Landlords frequently consider credit scores when evaluating rental applications. A good credit score can help you secure your desired apartment or rental property.

- Employment Opportunities: Some employers review credit scores as part of their hiring process, particularly for positions involving financial responsibility or security clearance.

Tips to Obtain a Good Credit Score:

- Pay Bills on Time: Consistently making payments by their due dates is one of the most critical factors in building good credit. Set up automatic payments or reminders to avoid missing any payments. Redstone Bank offers BillPay through our online banking and mobile app to help you easily set up automatic payments and never miss a bill due date again.

- Reduce Credit Utilization: Aim to keep your credit utilization ratio (the percentage of your available credit you’re using) below 30%. High utilization can negatively impact your credit score, so paying down existing balances is crucial.

- Build a Positive Credit History: Length of credit history matters. Keep old credit accounts open, maintain a mix of credit types (e.g., credit cards, loans), and use them responsibly to demonstrate your creditworthiness.

- Minimize New Credit Applications: Applying for multiple lines of credit within a short period can raise concerns about your financial stability. Only apply for new credit when necessary and be cautious about opening too many accounts.

- Regularly Monitor Your Credit: Obtain free copies of your credit reports from major credit bureaus and review them for errors or fraudulent activity. Report any discrepancies promptly to ensure your credit score accurately reflects your financial behavior.

A good credit score opens doors to financial opportunities and can positively impact various aspects of your life. By understanding the components that influence your credit score and adopting responsible financial habits, you can set yourself on the path to achieving and maintaining a good credit score. Remember, building credit takes time and patience, but the rewards are worth the effort. Start today and empower yourself with a solid financial foundation for a prosperous future.