By Dave Kochenberger | Mortgage Loan Officer | Centennial branch

For homeowners, one of the most valuable assets at their disposal is their home equity. Home equity represents the difference between the current market value of a property and the outstanding mortgage balance.

It can be a powerful tool for achieving financial goals and securing a stable future. However, to make the most of this resource, responsible management is key. Let’s explore the importance of being a good financial steward of your home equity and Home Equity Line of Credit (HELOC) usage while highlighting key strategies and potential pitfalls to avoid.

Understanding Home Equity and HELOC:

Home equity is a valuable asset that can be tapped into for various financial needs. It can serve as a resource to fund home improvements, educational expenses, debt consolidation, and even retirement. HELOC is a line of credit that allows homeowners to borrow against their home equity. It operates similarly to a credit card, with a predetermined credit limit and a variable interest rate. It is important to understand that a HELOC is secured by your home, making it essential to handle it responsibly.

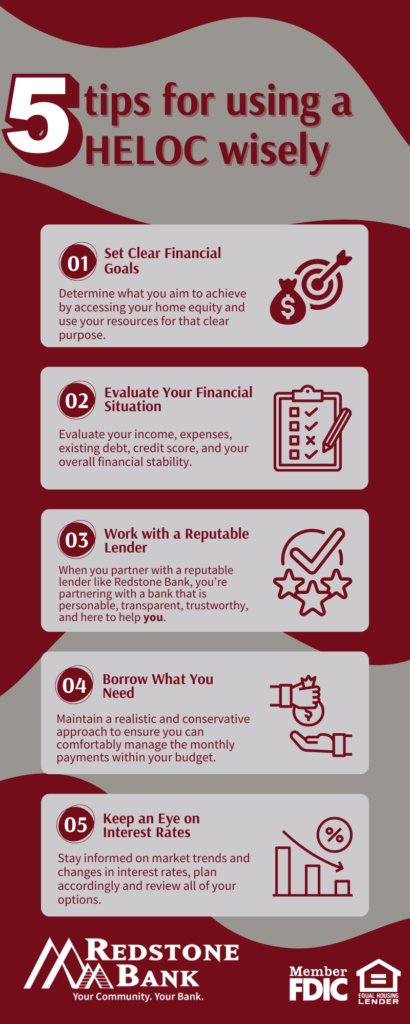

Set Clear Financial Goals:

Before diving into home equity or HELOC utilization, it is crucial to define your financial goals. Determine what you aim to achieve by accessing your home equity. It could be renovating your home, paying off high-interest debts, or investing in a business venture. Having a clear purpose will help you make informed decisions and ensure you are using your resources wisely.

Evaluate Your Financial Situation:

Assessing your financial situation is vital to determine if utilizing home equity or a HELOC is the right choice for you. Evaluate your income, expenses, and existing debts. Consider your credit score and overall financial stability. Responsible usage of home equity involves understanding your ability to repay the borrowed funds and managing the associated costs.

Work with a Reputable Lender:

When considering a HELOC, it is important to select a reputable lender, like Redstone Bank. We’ll sit down and discuss with you the terms, interest rates, and fees that we offer. When you partner with us, you know you’re partnering with a bank that is transparent, trustworthy and offers favorable terms. Any of our lenders are here to help you, listen to your needs, and find the right solution to help you reach your financial goals.

Borrow What You Need:

While a HELOC may provide access to a substantial credit limit, it is prudent to borrow only what you genuinely need. Borrowing excessively can lead to unnecessary debt and financial strain. Maintain a realistic and conservative approach, ensuring that you can comfortably manage the monthly payments within your budget.

Keep an Eye on Interest Rates:

HELOCs often come with variable interest rates, meaning they can fluctuate over time. Stay informed about market trends and changes in interest rates. Consider whether fixed-rate options or refinancing may be more suitable for your circumstances. Being aware of potential interest rate adjustments allows you to plan accordingly and avoid sudden financial burdens.

A Home Equity Line of Credit is a great way to access your home equity when needed. Call today to learn more about this dynamic product.

Pitfalls to Avoid:

- Frivolous Spending: Avoid using home equity or a HELOC for non-essential purchases or impulsive spending. Treat these resources as a financial lifeline rather than a source of extra cash.

- Ignoring Repayment Obligations: Make timely payments to avoid penalties and damaging your credit score. Falling behind on HELOC payments can lead to foreclosure or other serious consequences.

- Relying Solely on Home Equity: Diversify your financial portfolio by considering other investment options. Overdependence on home equity can expose you to market fluctuations and limit your financial growth.

- Neglecting Home Maintenance: While using home equity for renovations or repairs can be beneficial, be cautious not to overinvest in improvements that may not provide a good return on investment. Neglecting regular maintenance can lead to costly repairs down the line.

Being a good financial steward of your home equity and HELOC requires careful consideration and responsible decision-making. By setting clear goals, evaluating your financial situation, working with Redstone Bank, borrowing responsibly, and staying informed about interest rates, you can maximize the benefits of these resources while avoiding common pitfalls. Remember, home equity is a valuable asset that, when managed wisely, can contribute to your long-term financial stability and success. Contact any of our lenders today, and we can help you utilize your home equity and HELOC to achieve your goals.