With the current housing market and the rise in interest rates over the past year, homebuyers are questioning whether they should wait until the predicted interest rate drops.

Mortgage rates have a huge impact on the cost of buying a home, and it’s not surprising that homebuyers have been waiting for the rates to change. However, the interest rate should not be a key deciding factor in the decision about whether to buy a house.

Our mortgage lender, Dave Kochenberger, answers a few questions he frequently receives about buying a home in today’s market and offers advice on how to handle the current mortgage interest rate.

Q: Are rates high right now?

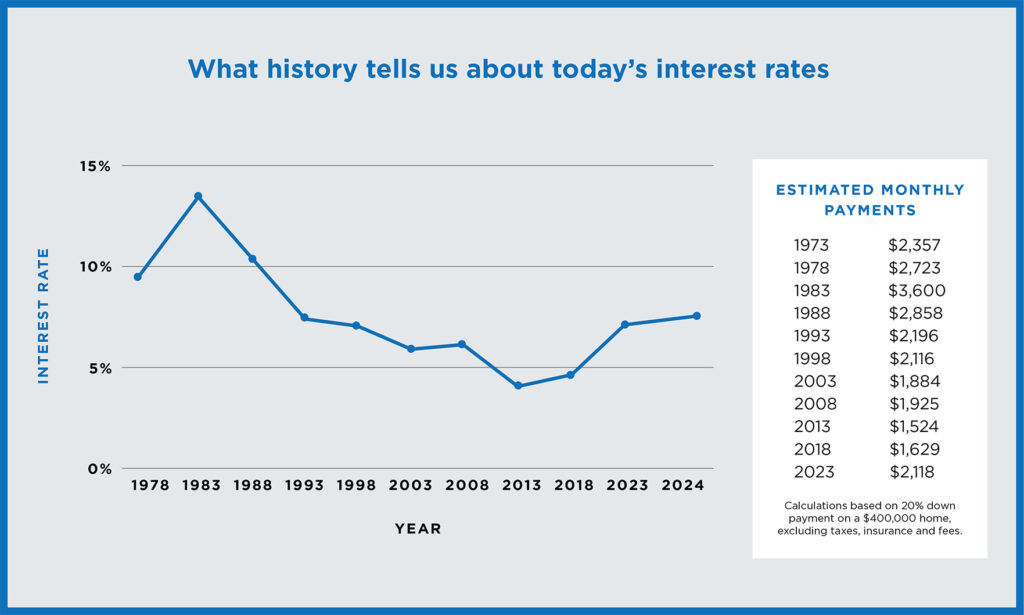

A: Technically speaking, interest rates are below their historical average. The average interest rate on a 30-year fixed mortgage from 1971 to today is 7.74%. However, it doesn’t feel like that to today’s homeowners. From June 2019 to March 2022, interest rates were below 4%. Today’s rates are around 6.875%, and this is a big move up over a short amount of time.

(What history tells us about today’s interest rates – Chicago Agent Magazine)

Q: Should I wait for rates to drop to buy a home?

A: If you find the house for you, I wouldn’t wait for rates to come down to make that purchase. Home prices continue to rise, and there are many buyers currently sitting on the sidelines. They will be coming out in droves as soon as interest rates come down. If/when interest rates come down, you can always refinance your mortgage to a lower rate.

Q: What is refinancing? Is there a time limit on when I can refinance if rates go down?

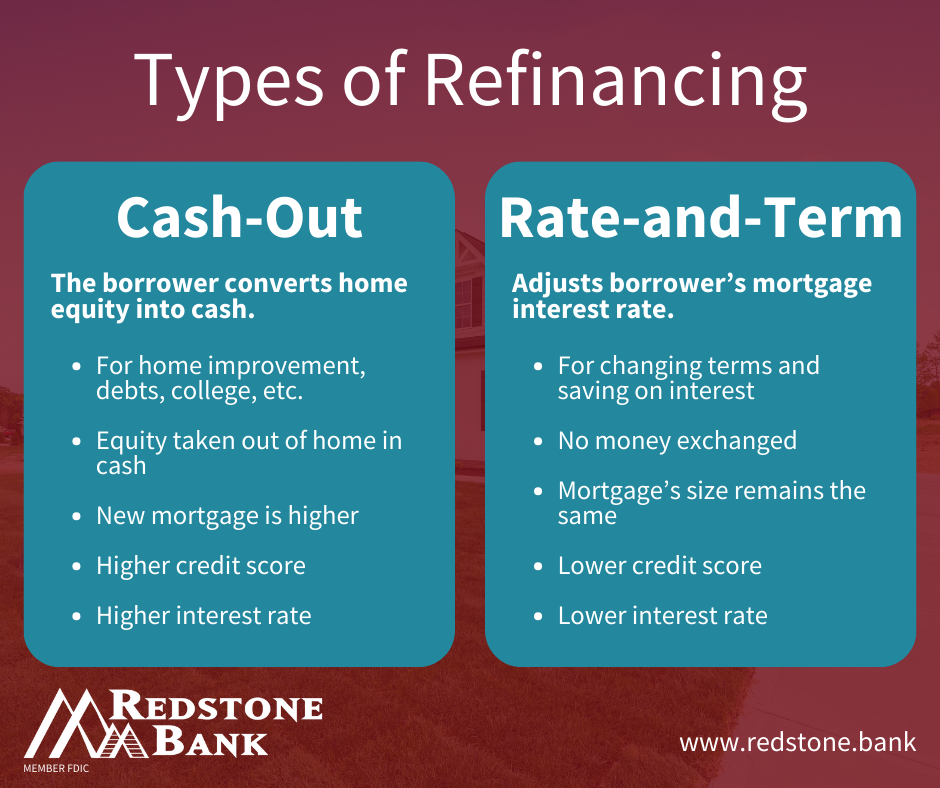

A: Refinancing is when a homeowner pays off their existing mortgage with a new mortgage at current market interest rates. There are various objectives to refinancing – some people take “cash-out” if they have enough equity, but most are looking to lock in a lower interest rate than they currently have and as a result, realize a lower monthly payment.

Most mortgages today do not have a “pre-payment” penalty, which means you could refinance an existing mortgage at any time. However, there are costs associated with refinancing, and it may take a year or two before it makes sense to proceed with a refinance.

Q: How can you help me as I prepare to buy a home in 2024?

A: Purchasing a home today is a big step in anyone’s life, particularly due to today’s home prices, interest rates, property taxes, and homeowner’s insurance. Everyone’s situation is different—I will sit down with you to analyze your short/long-term goals and go through a worst-case scenario budget with you. Preparation is the key, and you want to be ready no matter what comes your way!