Published April 8, 2024

Teaching children to save money is a valuable investment in their future financial well-being.

By starting good saving habits early on, parents empower their children to make informed financial decisions, set achievable goals, and build a solid foundation for a lifetime of financial success. With patience, guidance, and a supportive environment, parents can help raise money-savvy kids who are equipped to thrive in an increasingly complex financial landscape.

Here are a few ways to teach your children how to save money:

- Explain the difference between needs and wants, the value in saving and budgeting and the consequences of not doing so.

- Set up a chore chart and give your children an allowance for completing their tasks. Require them to save at least a small portion each week. The three jars method, one for spending, one for saving and one for charitable contributions is a good way to impart a sense of responsibility.

- Use a piggy Banks or savings jars to start saving. Provide children with physical containers to save their money. Labeling them for specific goals (like “college fund” or “toy fund”) can make saving more tangible and motivating.

- Teach Budgeting: Show children how to create a simple budget, allocating money for spending, saving, and sharing (e.g., charity or gifts). This helps them understand the value of budgeting and prioritizing expenses.

Open a savings account for your child at Redstone Bank! For more information, contact us.

Download Coloring Sheets

Needs vs. Wants Coloring Sheet

Color and Cut Savings Jar Wraps

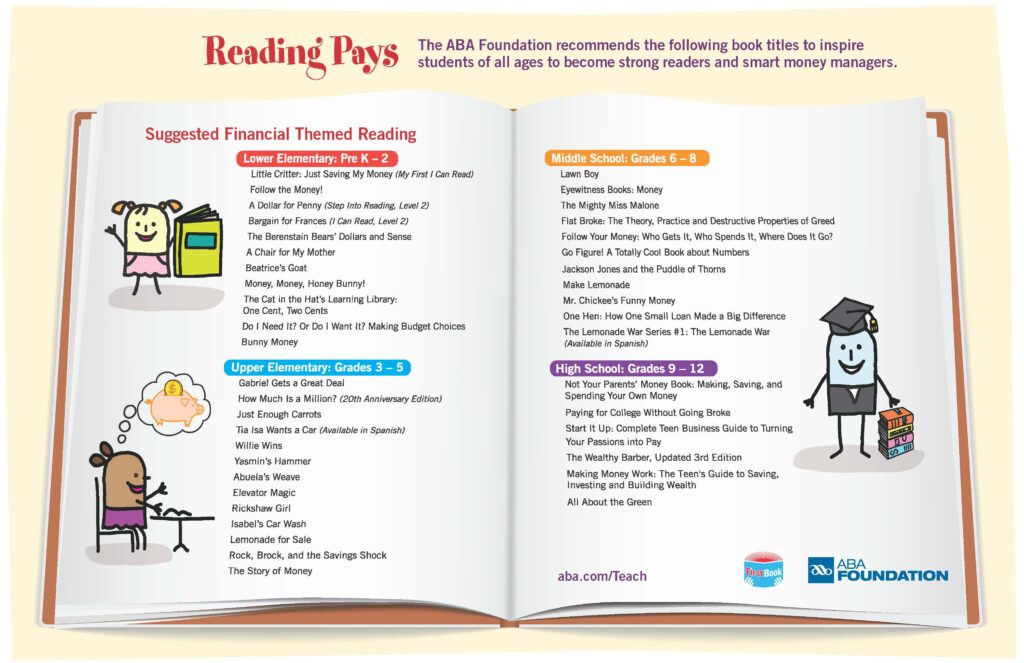

Books to Read

The ABA Foundation recommends the following books to inspire students of all ages to become smart money managers!